1) Overview:

The ultimate goal of Credit Management processes is to

minimize the financial risk that your organization assumes as a result of

day-to-day operations. Order Management's credit checking feature is the

process by which orders are validated and released against your credit checking

business rules. Using credit rules, system parameters, and credit profiles,

Order Management credit checking verifies that your customer has sufficient

credit availability with your organization to allow orders to be processed and

shipped in advance of payment. Order Management

enables you to perform credit checks on customer orders or order lines, and

automatically hold orders or lines that violate your credit setup.

2) Credit check functionality can work at any of

the following stages.

·

Order Entry

·

Picking

·

Packing

·

Shipping

3) In order to trigger

automatic Credit checking on sales orders it is necessary that the credit

checking is enabled for the order type, customer profile and payment terms

associated with the transaction.

Credit check set up

involves the following setup steps:

·

Credit Check Rules Setup

·

Customer Profiles Setup

·

Payment Terms Setup

·

Order Types Setup

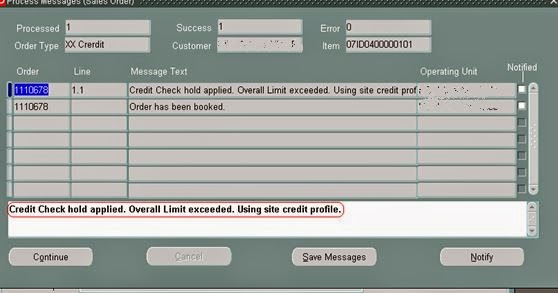

Sales orders that pass

credit check at all the three points (Profile, Order Type and Payment Term) are

allowed to progress normally. Those that fail will have credit check failure

hold placed on either the order header or order lines.

4)

Setups Involve enabling Credit Check Functionality:

5) Different Setup

Levels

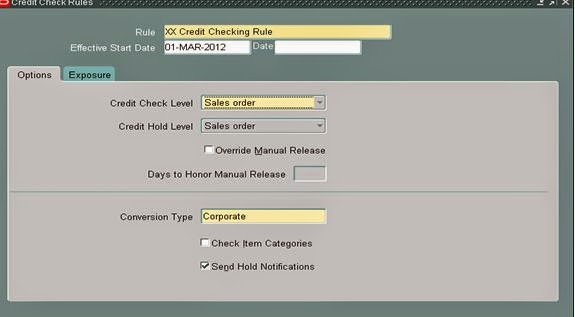

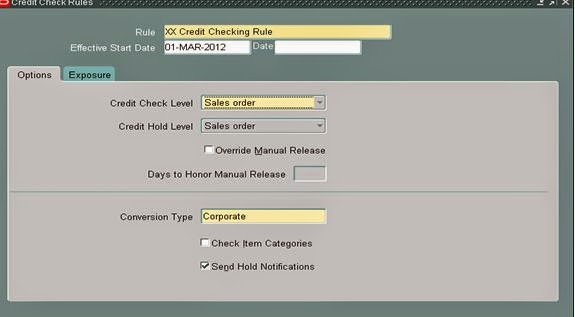

A. Credit

Check Rules Setup

SetupàRulesàCredit

Rule--

XX Credit Checking Rule

Credit

Check Level- Sales Order / Sales Order Line

Credit

Hold Level- Sales Order / Sales Order Line

Exposure

Tab:

Check

Use Pre-Calculated Exposure & Include External Credit Exposure

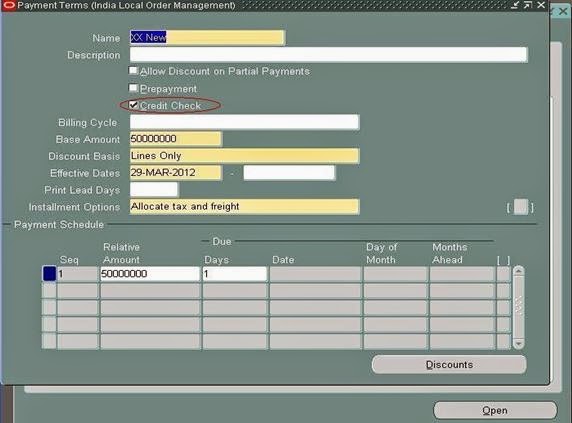

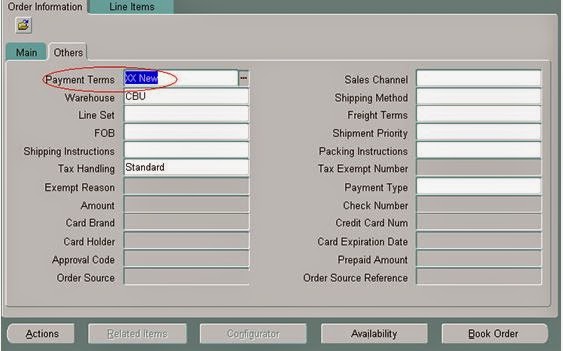

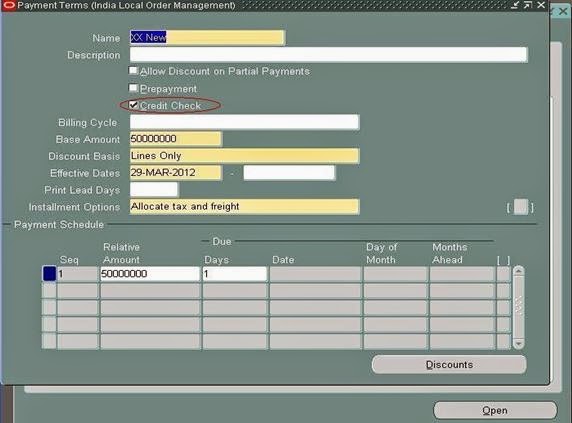

B.

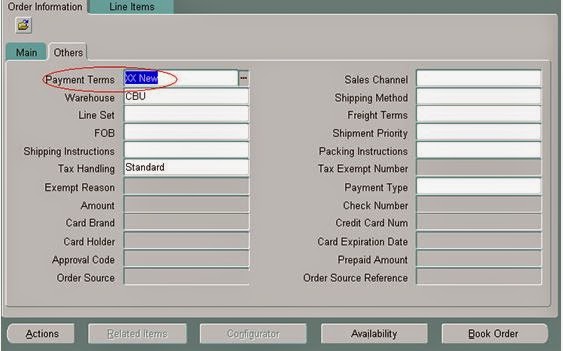

Payment Terms Setup

SetupàOrdersàPayment

Terms

Name:

XX New

Check

Box - Credit Check

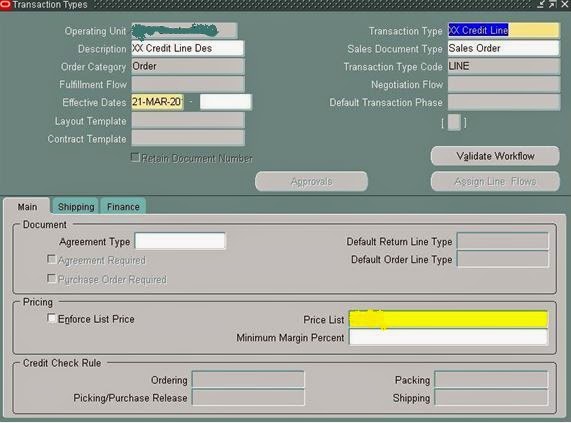

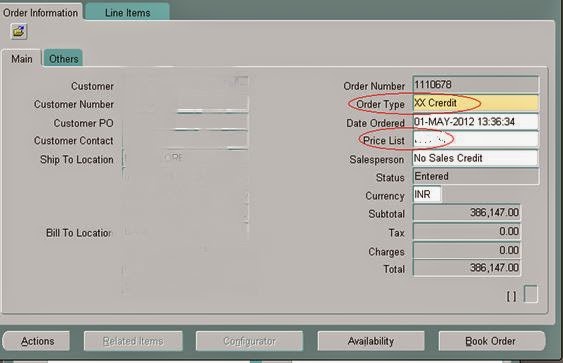

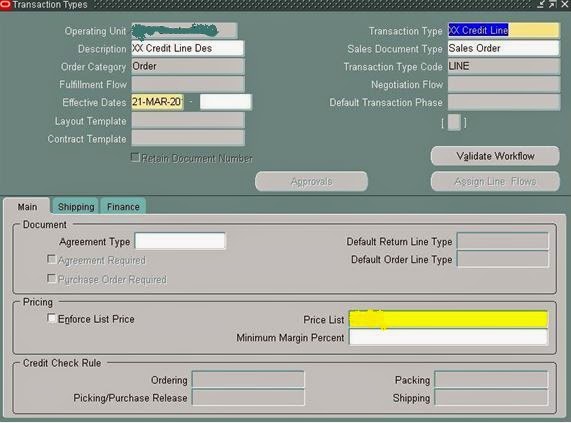

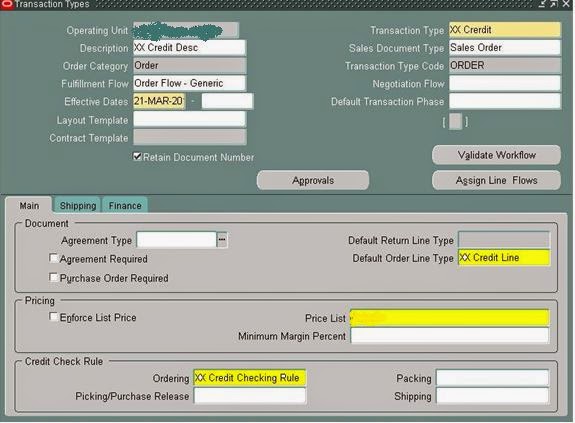

C. Order

Types Setup

SetupàTransaction TypesàDefine

<Defining

Line Type Transaction>

Transaction

Type – XX Credit Line

Order

Category- Order

Sales

Document Type - Sales Order

Transaction

type Code- LINE

Price

List- XXPriceList

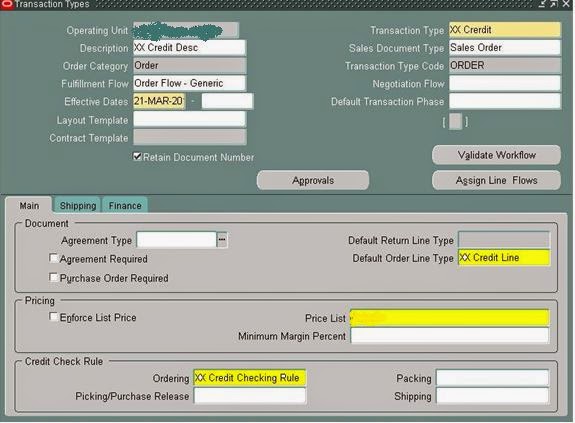

<Defining

Order Type Tansaction>

Transaction

Type – XX Credit

Order

Category- Order

Fulfillment

Flow - Order Flow - Generic

Sales

Document Type - Sales Order

Transaction

type Code- LINE

Default

Order Line Type- XX Credit Line

Price

List- XXPriceList

Credit

Check Rule-- XX Credit Checking Rule (Ordering Level)

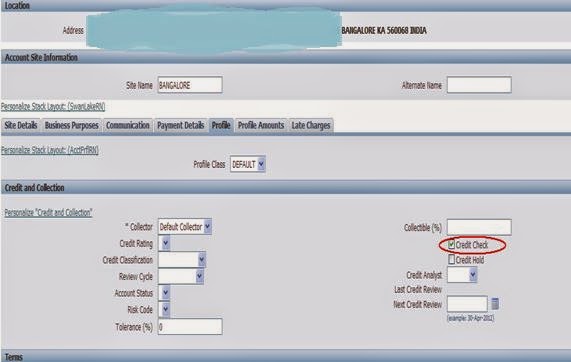

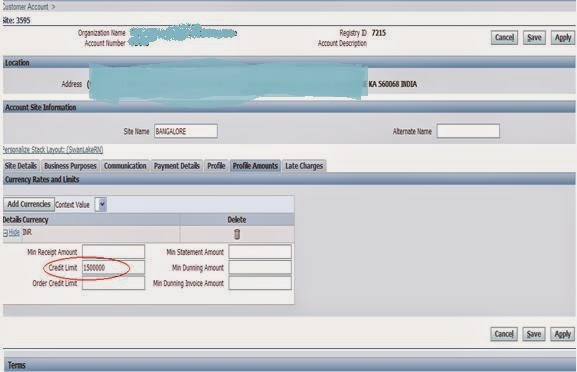

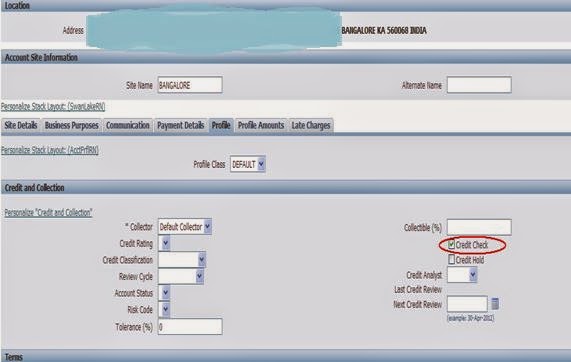

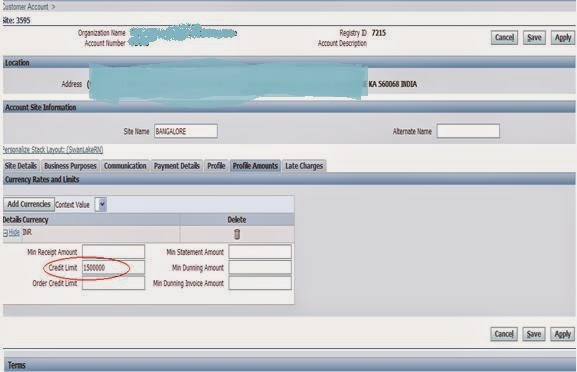

D. Customer

Profiles Setup

Customerà Standard

Search

Customer Nameà

AccountsàClick

Details

Select

Bill to siteà Open

Details

Profile

TabàEnable Credit

Check

Oracle Order Entry automatically holds customer orders that exceed credit limits. You can control who is authorized to release Credit Check holds when you want to make an exception or the customer's credit balance is acceptable. You can use Credit Check and Order credit limit either in Customer level or Customer site level.

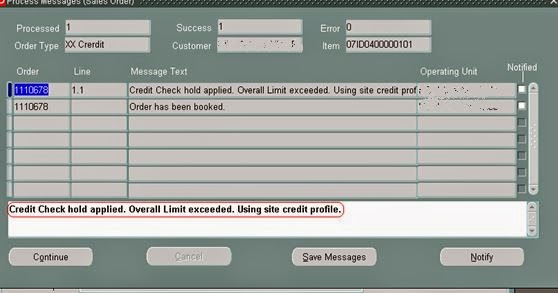

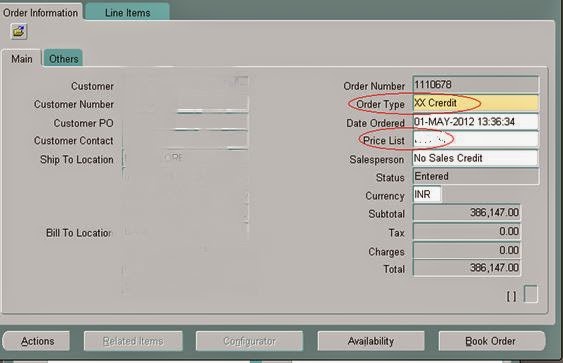

6) Entering

Sales Order

Enter the sales Order with all the above setup

criteria’s.

Order ReturnsàSales

Order

7) Deactivating

Credit Checking

There are three ways to deactivate Credit

Checking on an order:

- You can

use an Order Type that does not have an assigned credit check rule.

- You can

define the Customer Profile with ‘Credit Check’ checkbox unchecked.

- You can setup Payment Terms on Order /Line with ‘Credit Check’ checkbox unchecked.

Deactivating

Credit Checking does not automatically release orders previously on credit

check failure hold.

8)

Reports & Concurrent Programs Regarding Credit Check:

Credit Check Processor

Concurrent Program:

- Credit

Check Processor can automatically apply OR release order or order line

credit holds.

- Best use

of this program when you suspect your customers credit exposure has

changed and you want to re-evaluate their sales order status.

- You can

also use Credit check Processor whenever you change the customer credit

profile or credit check rule set up and you want these changes to

immediately take effect on your booked sales orders.

- Credit

check processor "always" uses Booking Credit check rule to

apply/release the holds.

- There is

limitation for applying the hold through credit check processor it

currently only considers exposure of the order lines which are in 'Booked'

status.

- When using pre-calculated exposure in credit check rule, run the ‘Initialize credit summaries’ concurrent program every time before running the credit check processor.

Initialize Credit

Summaries Table Concurrent Program:

·

This Program enables you to periodically rebuild

a credit exposure image for all customers or customer sites for all possible

credit rule definitions.

·

When you submit the ‘Initialize Credit

Summaries’ program, the changes to customer or customer site credit exposure is

calculated and updated in OE_CREDIT_SUMMARIES table.

·

Frequency to run Initialize Credit Summaries

will be based on ones business needs. If customer's credit exposure is changing

frequently, then probably you can run it frequently.

List of Credit Check Reports:

- Orders/Lines on Credit Check Hold Report:

The

Orders/Lines on Credit Check Hold Report shows customer balances for customers

with orders on credit hold to help you determine why their orders are on hold.

It identifies all the credit holds currently outstanding for a customer within

a date range, or identify why a particular order is on hold

- Outstanding Holds Report:

The

Outstanding Holds report shows orders on hold, including credit check hold, for

any or all customers. It reviews order holds for the customer or customers you

choose. This report displays the order number, order date, ordered items, and

order amount for each order line on hold for each customer you select.

- Credit Exposure Report

- Credit Order Detail Report

- Credit

Limit Usage Report

Hi Vimal,

ReplyDeleteGr8 Document.

Arpit

Keep it up, This gives me very useful information. Thanks for sharing this with us. The Desperation in Sales “Make a Customer Not a Sale”

ReplyDeleteIf a user is in Order Management, is there no way to check the customer's credit limit from the Order Management application?

ReplyDeleteHere is Mr Benjamin contact Email details, 247officedept@gmail.com. / Or Whatsapp +1 989-394-3740 that helped me with loan of 90,000.00 Euros to startup my business and I'm very grateful,It was really hard on me here trying to make a way as a single mother things hasn't be easy with me but with the help of Mr Benjamin put smile on my face as i watch my business growing stronger and expanding as well.I know you may surprise why me putting things like this here but i really have to express my gratitude so anyone seeking for financial help or going through hardship with there business or want to startup business project can see to this and have hope of getting out of the hardship..Thank You.

ReplyDeleteFantastic article post.Really thank you! Awesome.

ReplyDeletesap wm online training

sap fico online training

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete